41 short put payoff diagram

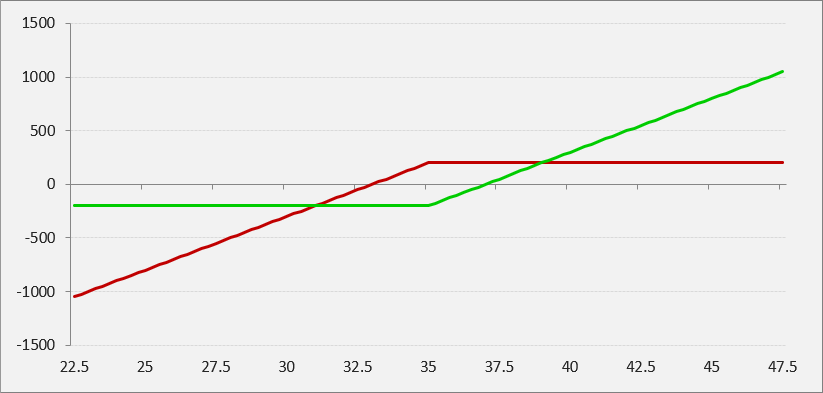

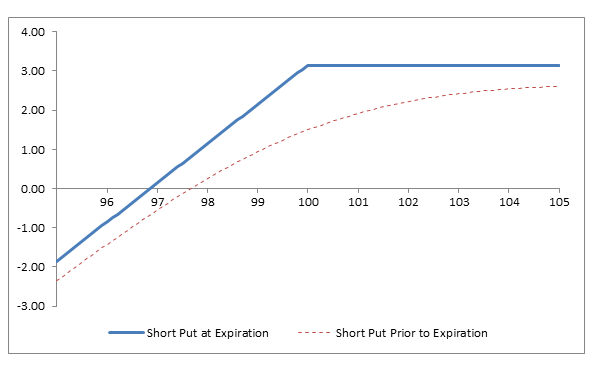

Profit Diagram - Short Put (Selling a Put). Just lower the payoff diagram by the call premium (price of the option), to get the. Payoff diagrams also known as payoff profiles visually display changes in the option strategy's profitability for changes in the underlying's price. Furthermore, here is a payoff diagram of a short put at expiration. It works like a short call just the other way around. The short put profits from an...

Put Writer Payoff Diagrams. Additional Forward and Futures Contract Tutorials. American Call Options. Basic Shorting. Put Payoff Diagram. Put as Insurance. Put-Call Parity. Long Straddle. Call Writer Payoff Diagram. Arbitrage Basics.

Short put payoff diagram

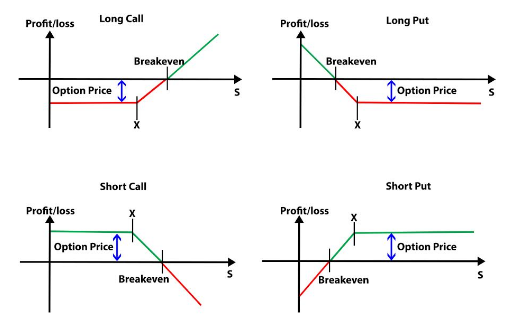

Short an option: If we short an option, the holder of the option has the right to exercise against us. The holder will exercise the option if it will result in a positive payoff for him or her. Above we look at the payoff diagrams for buying and selling puts and calls. Payoff diagrams are simply diagrammatic representation of payoffs at termination/expiration of a contract w.r.t value of the underlying $latex S_T$. For Short Put: With this idea in place, we can also talk about the payoff diagram of an underlying itself w.r.t itself. This is of course trivial, because a... Put-Call Parity: Payoff Diagram. -a short position in the riskless zero with par value K. ƒTherefore, in the absence of arbitrage, the current price of the call must equal the Let ∆ represent the number of units of the underlying bond needed to hedge a short position in a call option. ∆ must make the net...

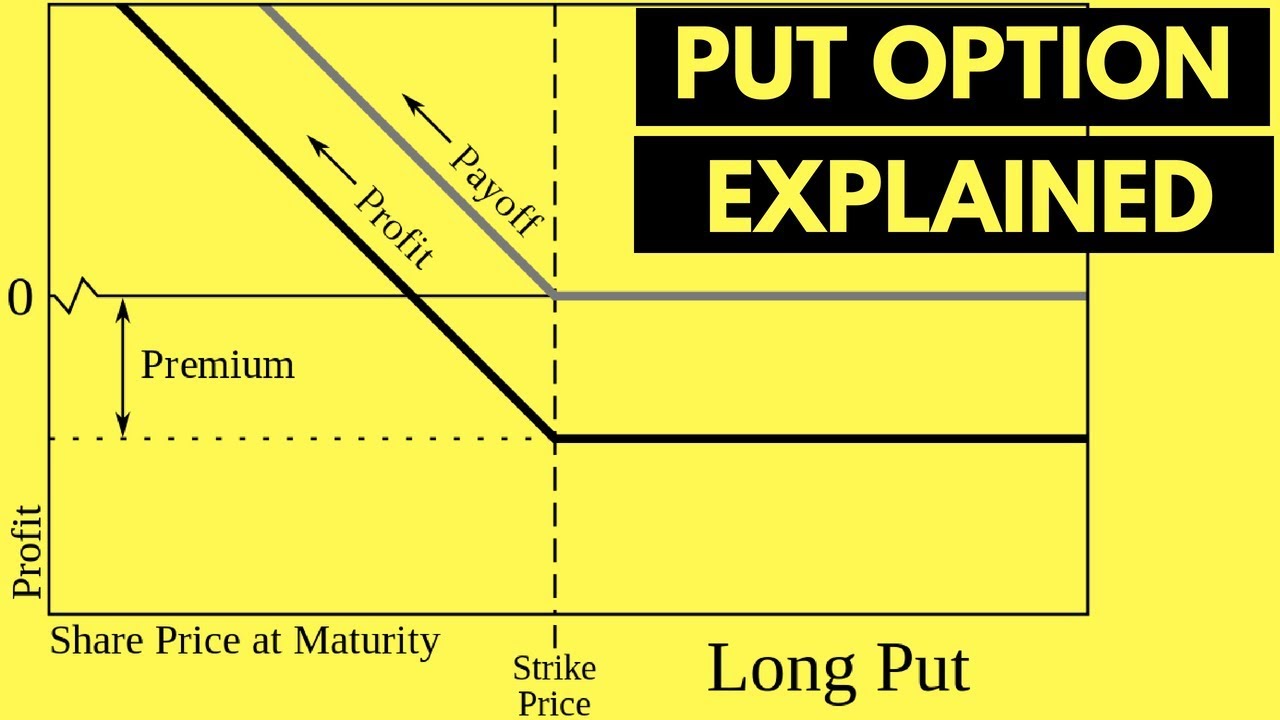

Short put payoff diagram. A synthetic short put is created when long stock position is combined with a short call of the same series. It is so named because the established position has the same profit potential a short put. Synthetic Short Put Construction. Long 100 Shares Sell 1 ATM Call. A short put spread obligates you to buy the stock at strike price B if the option is assigned but gives you the right to sell stock at strike price A. A short put spread is an alternative to the short put. In addition to selling a put with strike B, you’re buying the cheaper put with strike A to limit your risk if the stock goes down. A Payoff diagram is a graphical representation of the potential outcomes of a strategy. Results may be depicted at any point in time, although the graph usually Long Put Strategy Short Put Strategy A long put is simply the purchase of one put A short put is simply the sale of a put option. option. Payoff diagrams are an illustrative way to estimate at a glance the maximum positive or negative revenue from an options position/strategy, if held until expiration. So, the long put strategy has limited risk and limited but quite high potential profit (until the stock goes to zero). Profit diagram of short put.

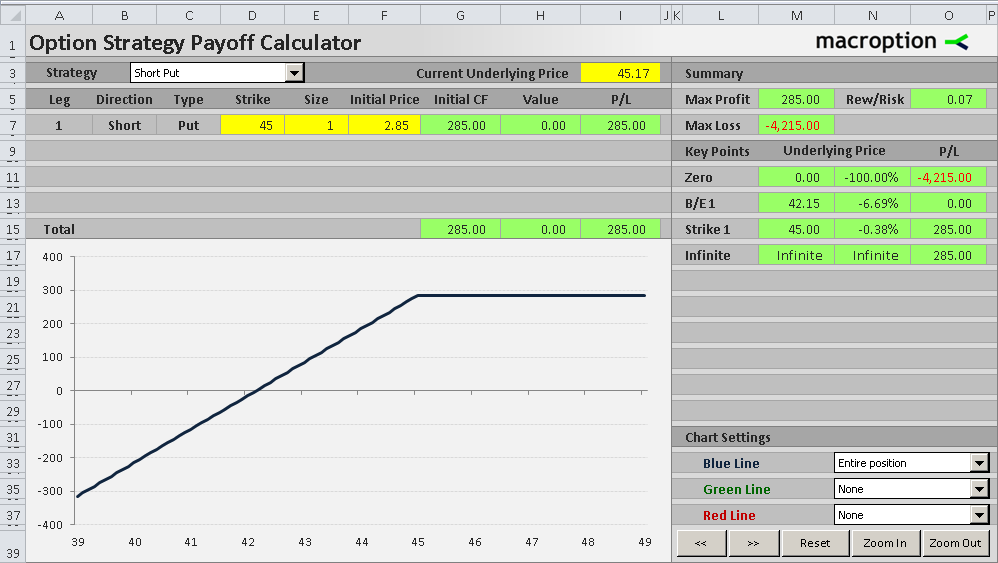

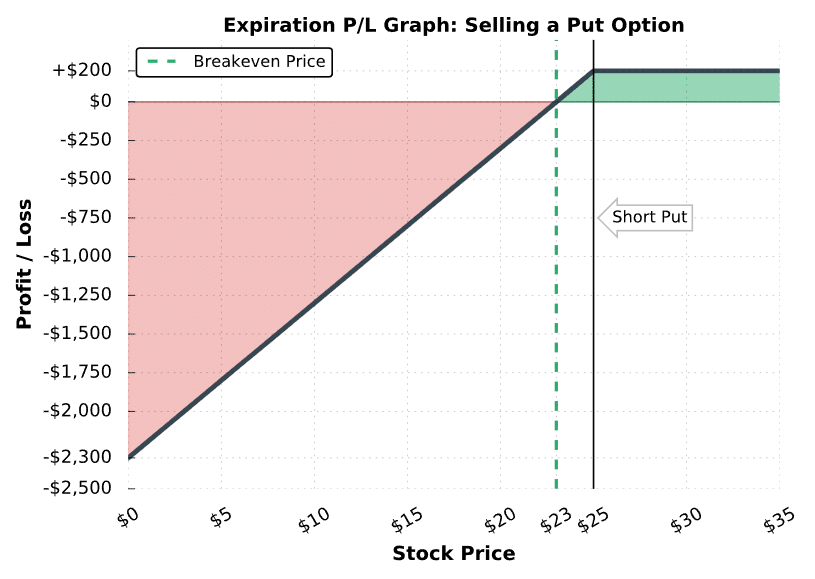

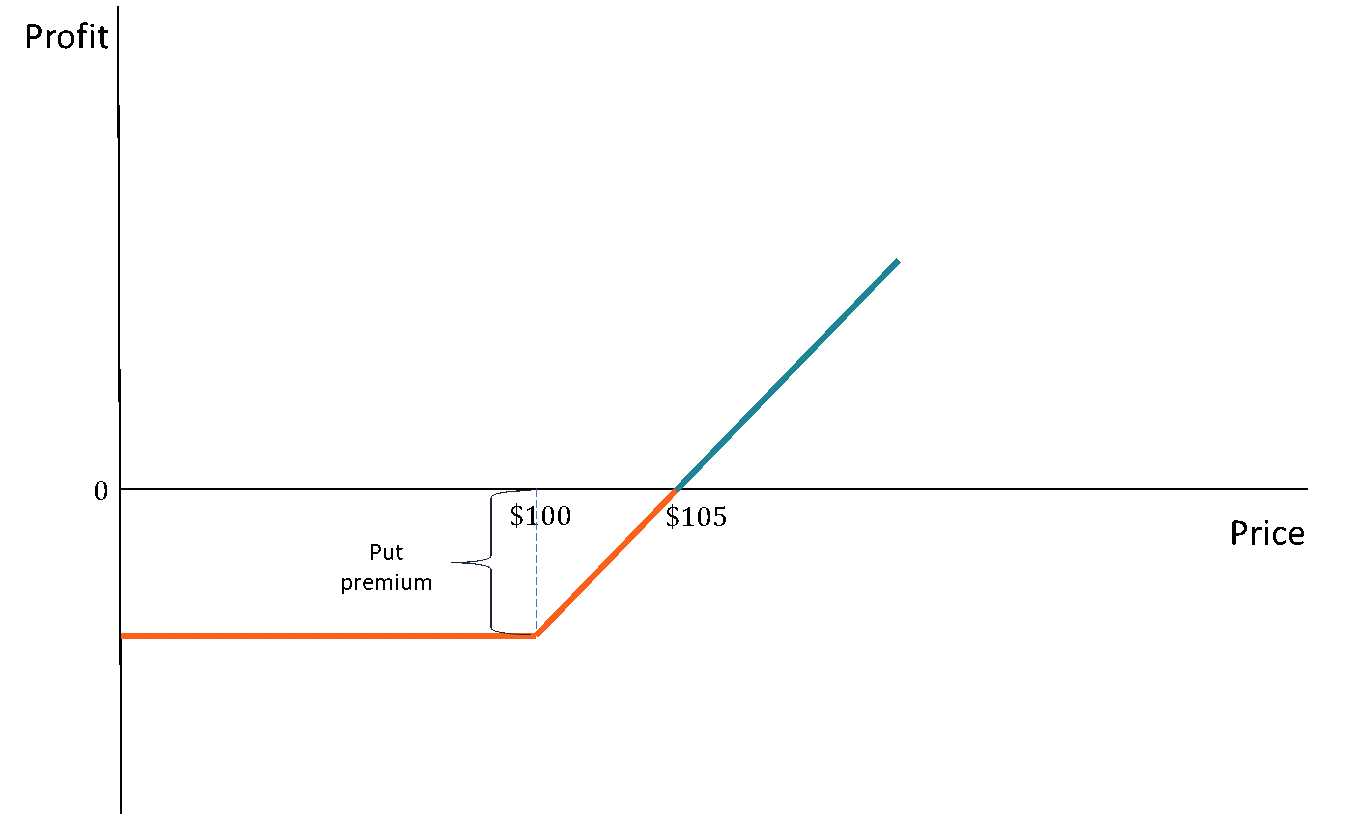

Short Put Payoff Diagram A short put option position is a bullish strategy with limited upside and limited (but usually very high) risk. The position is initiated by selling a put option with the intention to buy it back later at a lower price or waiting until expiration and hoping it will expire out of the money. See the payoff chart below: Besides the strike price, another important point on the payoff diagram is the break-even point, which is the underlying price where the position turns from losing to profitable (or vice-versa). On the chart it is the point where the profit/loss line crosses the zero line and you can see it’s somewhere between 37 and 38 in our example. The payoffs for a short call, a long put and a short put are given below: How to remember what different payoff diagrams look like Imagine an options portfolio with a long call and a short put position, both with the same exercise price.This will have the following payoff The payoff diagram for a short put represents the risk involved with selling naked options. Profit potential is limited to the amount of credit received when the put is sold. The risk is undefined until the stock reaches $0. For example, if a short put option with a strike price of $100 is sold for $5.00, the maximum profit potential is $500.

Question: Short Put P=0.91,K3, T=1r-20% Payoff equation -Max(x-SA) Profit equation Payoff and profit diagram Payoff and profit table De Po 5 Prote 7 5 4 41 91 .41 99 .91 10.64 1.04 2-04 This problem has been solved! Some of the links within certain pages are affiliate links of which TradeOptionsWithMe receives a small compensation from sales of certain items. Option payoff diagrams are profit and loss charts that show the risk/reward profile of an option or Outright calls and puts are fairly straight forward to understand when it comes to payoff and P&L A straddle is a combination of two options; a long call and long put option with the same expiration... A put payoff diagram is a way of visualizing the value of a put option at expiration based on the value of the underlying stock. Learn how to create and interpret put payoff diagrams in this video. Created by Sal Khan. Google Classroom Facebook Twitter Email Sort by: Tips & Thanks Video transcript

Introduction. Option Payoff. Put-Call Parity. Synthetic Positions. Put-Call Parity and Arbitrage Strategies. Introduction. In this chapter, we will discuss the option's payoff if you long or short the options. The above payoff diagrams illustrate the cash payoff on an option at the expiration date.

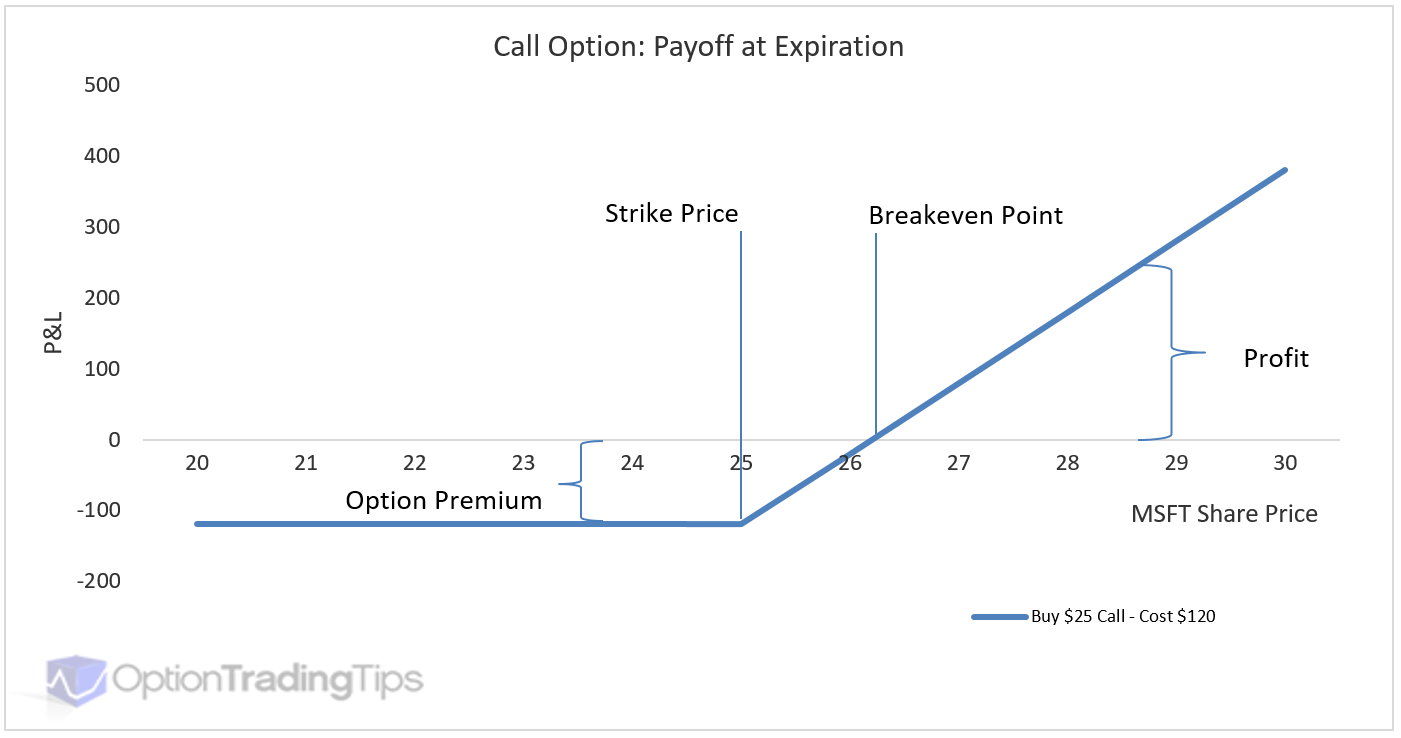

An option payoff diagram is used to illustrate how an option will perform given the movement of the underlying price. Since option buyers have a defined risk (i.e. they can lose no more than the cost they paid for the option) an option Payoff Diagram. Featured video External links Comments. Definition.

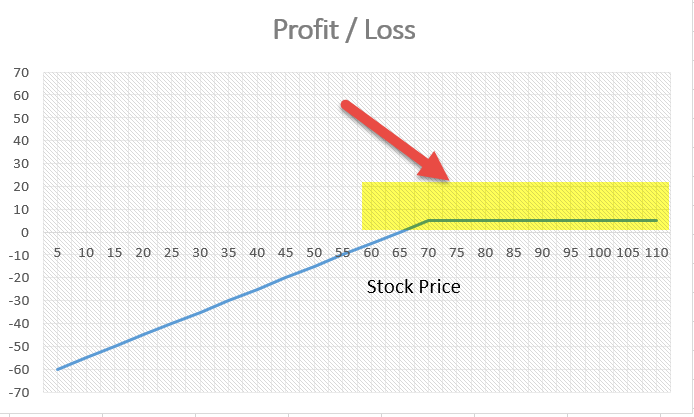

What we are looking at here is the payoff graph for a short put option strategy. In this example the trader has sold a 330 strike put for $6 per contract (or $600 for a standard option contract representing 100 shares). The premium collected of $600 is the most the trade can profit. That occurs at an underlying stock price of $330 and above.

The payoff diagram of a put option looks like a mirror image of the call option (along the Y axis). This diagram shows the option's payoff as the underlying price changes for the long put position. If the stock is above the strike at expiration, the put expires worthless.

What is the payoff for Short Put Option? A Short Put is known as Limited Profit Limited Loss position. As you can see from the payoff function above, the PINK graph demonstrates the payoff function for your Short Put Option Position, but without taking the price (or option premium) amount...

Short put option payoff diagram. Credits to optionsplaybook.com. Option Combinations - Strategies. The above is your payoff diagram when you short a straddle. This involves selling a call and put option at the same strike price.

Short put: sellers of put options hope the stock price to go up or stay around current levels.If the asset price decreases, options sellers are obliged to buy shares at a predetermined price (strike). A seller of a put option receives a premium, that is, the profit potential is limited and known in advance, while risks are conditionally unlimited.

Memorizing the payoff diagrams for long/short calls/puts makes it easier to intuit the strategies and consequences/payoffs. I didn't memorize the formulas A few weeks ago I put together a YouTube video going over my tips and tricks for clearing Level 1, and now, I put together a video for Level 2. I...

Put Option Payoff Graph. Options Trading 101 - The Ultimate Beginners Guide To Options. Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position's total profit or loss (Y-axis) depending on...

Exercise for payoff diagram IV. Assigned problems from the textbook. 3. Using Put-Call Parity to value puts → Payoff from buying put = Payoff from buying call + Payoff from short selling stock, + Payoff from lending the present value of the exercise price → P0 = C0 - S0 + E...

Please find below the pay off diagrams for the four different option variants -. Arranging the Payoff diagrams in the above fashion helps us Likewise, whenever you sell an option, it is called a 'Short' position. Going by that, selling a call option and selling a put option is also called Short Call and...

Understanding payoff graphs (or diagrams as they are sometimes referred) is absolutely essential for option traders. A payoff graph will show the option position’s total profit or loss (Y-axis) depending on the underlying price (x-axis). Here is an example: What we are looking at here is the payoff graph for a short call option strategy.

Basics of Long Call/Put and Short Call/Put. In this video i have explained what is Long/Short call and put Option with example and payoff chart and also potential advantages and disadvantages of this strategy, and how to best implement it in your portfolio.

The Payoff for Writing Put Options. A put option gives the holder of the option the right to sell an asset by a certain date at a certain price. Hence, Payoff of short put option = min(ST - X, 0) or. The Payoff of the diagram of the covered put option is shown in image-1.

q A put option gives its holder the right to sell the underlying asset at a strike price. q If you hold either a call or a put, you have a long position in the q When the immediate exercise of an option would result in a positive payoff, the option is called "in the money." q Options can be in, out of, or at the money.

Payoff diagrams for options are more complicated than those of a futures contract. This is because the payoff structure of an options contract does not only depend on investors' long or short position in the options market, but also depends on the type of the option, ie, whether it is a call option or a put option.

"Pay off diagrams" a good way to understand the profits and losses with a strategy. A convenient way to envision what happens with option strategies as the value of the underlying asset changes is with the use of a profit and loss diagram, known as a "payoff diagram".

Short put option diagram. The four situations are the basic forms of a profit and loss diagram associated with options trading. Additional Resources on Payoff Graphs vs Profit & Loss Diagrams. CFI is the official provider of the Financial Modeling and Valuation Analyst (FMVA)™Become a...

Put-Call Parity: Payoff Diagram. -a short position in the riskless zero with par value K. ƒTherefore, in the absence of arbitrage, the current price of the call must equal the Let ∆ represent the number of units of the underlying bond needed to hedge a short position in a call option. ∆ must make the net...

Payoff diagrams are simply diagrammatic representation of payoffs at termination/expiration of a contract w.r.t value of the underlying $latex S_T$. For Short Put: With this idea in place, we can also talk about the payoff diagram of an underlying itself w.r.t itself. This is of course trivial, because a...

Short an option: If we short an option, the holder of the option has the right to exercise against us. The holder will exercise the option if it will result in a positive payoff for him or her. Above we look at the payoff diagrams for buying and selling puts and calls.

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

![Short Put Strategy Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6077697fa426b477ca4450e5_Short%20Put%20-%20Adjust%20to%20Bull%20Put%20Spread.png)

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

.png)

0 Response to "41 short put payoff diagram"

Post a Comment